Incoming cash flow that businesses generate is advantageous for funding investments, paying down liabilities, and covering operational expenses. Where to allocate funds and resources to best support credit payments can be determined by understanding how your company uses its incoming cash to pay for its liabilities. Because you are looking for the yearly average you ask to see the previous years financial statements. Also, keeping track of AP benchmarks helps determine how well your AP department functions, cash flow, and overall supplier satisfaction. With AP automation, teams can collaborate anytime and from any location to make important decisions that support continued production and improve brand reputation.

- The accounts payable turnover ratio is a liquidity ratio that shows a company’s ability to pay off its accounts payable by comparing net credit purchases to the average accounts payable during a period.

- Opening and closing balance of accounts payable for XYZ company amount to $20,000 and $30,000 for the year ended June 31, 2021.

- A higher average payment period is desirable from a working capital perspective, and it’s the only item in the sales cycle that positively impacts the working capital cycle.

- Finding the right balance between managing breads and maintaining strong supplier relationships is essential —understanding your DPO is key to achieving this.

iCalculator™ Finance Home

Continued evaluation is critical to staying productive and profitable in a constantly changing global marketplace. AP automation provides a secure and collaborative environment to share financial data in real time and make about casualty deduction for federal income tax time-sensitive decisions when they matter most. Accounts payable days (DPO) is not a one-size-fits-all metric; it varies widely across different industries, reflecting distinct operational and financial practices.

What Is Days Payable Outstanding – DPO?

A high ratio means there is a relatively short time between purchase of goods and services and payment for them. This value informs the accountant that the company pays off its short-term liabilities on average every 47 days. This period of time is effective because it demonstrates that the business has sufficient incoming cash flow to cover its liabilities and the ability to pay them off on schedule. The APP ratio of a company can provide important information about its overall financial operations. The APP displays the typical time businesses take to use revenues for covering these types of costs.

. Are the average payment period and average collection period the same?

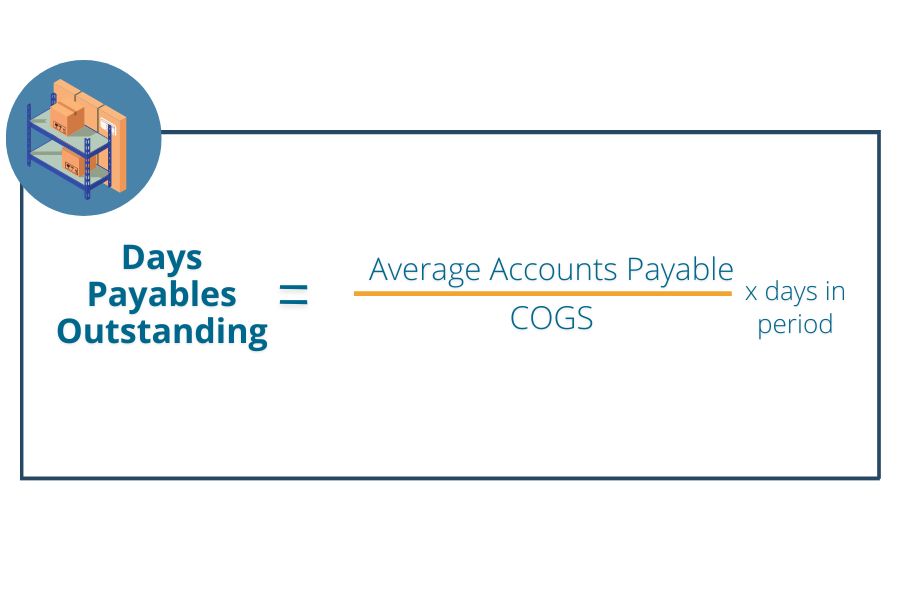

DPO attempts to measure this average time cycle for outward payments and is calculated by taking the standard accounting figures into consideration over a specified period of time. It results in accounts payable (AP), a key accounting entry that represents a company’s obligation to pay off the short-term liabilities to its creditors or suppliers. The days payable outstanding (DPO) ratio, which measures a company’s solvency, measures how long it takes a company to pay its short-term liabilities, particularly for purchases it makes on credit. An essential financial metric for companies to assess how well they settle their debts quickly is the average payment period. Most businesses measure APP once a year, but some do so every quarter or according to the deadlines set by creditors. To analysts and investors, making timely payments is important but not necessarily at the fastest rate possible.

Is Average Payment Period and Average Collection Period same?

The ideal Days Payable Outstanding depends on your business needs and industry benchmarks, with no universal standard. The relationship between DSO and DPO can indicate the balance between inflows and outflows of cash. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Days Payable Outstanding FAQs

The average payment period (APP) is a critical metric used in management accounting and finance. It refers to the average amount of time taken by a company to pay off its accounts payable. Accounts payable represents the amount that a company owes to its suppliers or vendors for goods or services purchased on credit. The calculation of Average Payment Period gives insights into a company’s cash management strategies and short-term liquidity position.

A shorter average payment period ratio shows that the company makes invoice payments relatively quickly, which can be because of favorable payment terms or effective cash management. A more extended APP suggests that the company takes longer to pay its invoices, which can be a strategy to manage or show cash flow issues. DPO focuses on how long a company takes to pay its suppliers, while DSO measures how quickly a company collects payments from its customers. By understanding these ratios, a company can better manage its cash flow and liquidity position.

So it is necessary to have a strong payment history and good cash flow position for the same, which can be used for bargaining. Average Payment Period is one of the important solvency ratios of the company and helps a company track and know its ability to pay the amount payable to its creditors. Based on the given values, the average payment period for the company is 60.83 days. With Stenn’s revenue-based financing options, you can seamlessly bridge cashflow gaps and accelerate your business growth. It’s essential to maintain open communication with suppliers and avoid excessive delays. By extending payment terms to suppliers, you can preserve cash for investments or operational needs.

Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others. This team of experts helps Carbon Collective maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with years of experience in areas of personal finance and climate. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Accounts payable are short-term debt that a company owes to its suppliers and creditors. The accounts payable turnover ratio shows how efficient a company is at paying its suppliers and short-term debts. The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Accounts payable turnover shows how many times a company pays off its accounts payable during a period. To find out the average payable period the first step is to find out the account payable turnover ratio or total accounts payable turnover (TAPT). Accumulate all the purchases that you have made during a year (or a period of your choice) and divide it by the average accounts payable during the same time period.

However, a low DPO can also show the company is taking advantage of money-saving discounts for early payments and nurturing strong supplier relationships for improved production times. Either way, management must continually gauge AP workflows to determine the reasons for a high or low DPO. AP automation provides financial data in real-time for instant analysis of the full process AP cycle. If a supplier is giving let’s say a discount of 10% for the company to pay them in 30 days then the company should evaluate if it has enough cash flow to meet the obligation in 30 days.